Analysis

Unlocking Urban Finance: The Vital Role of Project Preparation for City Projects

As cities work to develop and implement transformative climate projects, access to finance is critical. Project Preparation Facilities (PPFs) can help cities ensure their projects are structured to attract funding.

Image: Pexels/ M I N E I A M A R T I N S

By John-Rob Pool (World Resources Institute), Eillie Anzilotti (World Resources Institute), Francisco Martes Porto Macedo (Climate Policy Initiative), Jessy Appavoo (C40 Cities), Andre Almeida da Vila (ICLEI - Local Governments for Sustainability), Bruno Incau (WRI Brasil) and Magdala Arioli (WRI Brasil).

In 2023, Moldova’s capital city, Chisinau, secured a €20 million investment to tackle flooding and pollution of the River Bic and transform it into a valuable recreational amenity for 100,000 members of the public and to mitigate the risks of future flooding. This funding, which combines loans from the European Bank for Reconstruction and Development (EBRD) and the European Investment Bank (EIB) with a grant from the Green Climate Fund (GCF), will support both engineered and nature-based solutions to manage stormwater, improve water quality, and enhance recreational spaces – and marks the first time that EBRD has formally financed NbS in an urban project. The EBRD’s Green Cities Program played an instrumental role in securing this investment by helping Chisinau develop green city action plan that emphasized the need for improved climate adaptation and water quality, ultimately leading to conceptualization of the River Bic restoration project and then attracting the necessary finance to implement the project.

As the dual climate and nature crises grow, cities must invest in transformative projects that address both challenges while meeting the social and infrastructural needs of their residents. And they must do so quickly and at scale. Cities are the world’s economic engines, innovation hubs, and centers of political heft and cultural exchange. As they find themselves on the frontlines of the climate and nature crises, investors are taking note: By 2030, climate investment opportunities in cities – where 75% of the infrastructure expected to be in place by 2050 to support burgeoning urban populations has yet to be built – are expected to reach a cumulative total of $29.4 trillion by 2030.

However, multiple challenges prevent cities from mobilizing the investments required to accelerate the green transition in urban areas at the pace and scale that is needed. Accessing finance for climate-resilient and nature-positive projects can often be a daunting challenge for urban planners and policymakers, especially for those in the global South where domestic budgets and fiscal autonomy are constrained, credit ratings are weak, and technical capacity is limited. This is where project preparation facilities (PPFs) come in. These specialized entities provide technical assistance, financial support, and capacity-building services to cities as they prepare and structure their development projects. Bridging the gap between cities’ goals and their financial viability, PPFs play a vital role in scaling up access to finance and driving urban transformation.

Contextualizing the Urban Finance Challenge

Urbanization is an inevitable global phenomenon: By 2050, over two-thirds of the world's population will reside in urban areas. And as cities continue to grow, so do their complex challenges: from aging infrastructure and inadequate housing to environmental degradation and social inequality. Further, public coffers are constrained by losses due to the impacts of climate change, the aftermath of the COVID-19 pandemic, and the global cost of living crisis. Addressing these challenges requires substantial financial resources, often beyond the capacity of individual cities or public-sector budgets.

City access to finance from domestic and international public and private financiers for development projects is hindered by various challenges, including a comprehensive lack of feasibility within project proposals. Oftentimes, investors perceive limited opportunities for financing due to insufficient risk analysis, lack of demonstrated and reliable revenue streams to repay investments, or insufficient scale, which result in higher-than-normal transaction costs. The mismatch between the long-term nature of urban development projects and the short-term investment horizons of many financiers exacerbates this problem.

The Role of Project Preparation Facilities

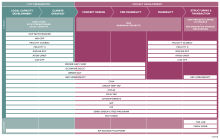

PPFs can play a pivotal role in overcoming these barriers and catalyzing urban finance. By addressing the challenges of project development, PPFs work to deliver the relevant analyses, assessments, and options to improve the quality and enhance the attractiveness of urban investments to both public and private financiers. PPFs support the preparation of urban projects throughout the project development phase, often categorized into four stages: (1) concept, design and scoping, (2) pre-feasibility, (3) feasibility, and (4) structuring and transaction. Irrespective of the stage, PPFs help prepare urban projects for investment by addressing four key areas of support:

1. Capacity Building and Technical Assistance

Many PPFs offer valuable technical assistance to local governments and project developers that helps them to build their own technical capacity. This includes guidance in project identification, feasibility assessment, financial modeling, risk management, and development of plans and strategies – such as climate action plans and adaptation strategies, that often catalyze the conceptualization of new and innovative project ideas. By equipping city stakeholders with the necessary skills and knowledge, PPFs empower them to develop high-quality project proposals that meet the requirements of potential investors.

2. Project Structuring and Risk Mitigation

A key function of PPFs is to assist in structuring projects to make them more attractive to investors. This involves demonstrating the technical viability of a particular project or solution as well as optimizing a project’s financial, legal, and operational aspects to minimize risks and enhance investment returns. PPFs help projects explore different mechanisms — such as risk-sharing instruments, guarantees, and insurance products — to mitigate the perceived risks associated with investments in clean technologies and solutions in urban settings, making projects more financially attractive to oftentimes risk-averse investors.

3. Facilitating Access to Finance

By preparing investment-ready projects, PPFs bridge the gap between local governments and financiers. They act as intermediaries, facilitating connections between public and private investors, multilateral development banks, and other sources of public and private capital. PPFs can also help in mobilizing funding through innovative financing mechanisms, such as blended finance, public-private partnerships (PPPs), and impact investing.

4. Promoting Sustainability and Inclusivity

PPFs can play a vital role in raising the bar on sustainability, equity, gender, and inclusivity aspects of urban development projects. By embedding these principles into project design and implementation, PPFs contribute to building the cities of the future that are more livable, resilient, and inclusive for all residents.

PPFs in Action: Case Studies from Five Global PPFs

Around the world, numerous PPFs and other kinds of institutions providing project preparation support to cities exist. Many are part of the Cities Climate Finance Leadership Alliance’s (CCFLA) Leadership for Urban Climate Investment (LUCI) framework, which aims to coordinate efforts between PPFs and like-minded organizations to help 2,000 cities prepare 1,000 climate resilient projects and link them to finance for implementation.

1. Subnational Climate Fund

The Subnational Climate Fund (SCF), launched by Pegasus Capital Advisors, International Union for Conservation of Nature and others, is a prime example of a PPF that focuses on mobilizing finance through a combination of concessional and conventional loans, particularly for projects with a focus on sustainability and nature-based climate solutions. The SCF provides technical assistance, advisory services and financial support to develop and structure bankable projects in sectors such as transportation, energy, water, and urban development, primarily with subnational authorities, with the goal of improving the lives of 17 million urban residents and creating 20,000 direct jobs.

In Portoviejo, Ecuador, a lack of water management infrastructure means that the majority of the municipal solid waste generated by the 400,000 residents is landfilled, oftentimes under unsanitary conditions. Ecuador’s National Waste Management Program aims to eliminate open and informal dumpsites and increase the recovery of recyclable materials from only 6% nationwide. To address this challenge, the SCF has provided technical assistance to Portoviejo in the form of feasibility studies and environmental and social impact assessments to develop a new waste management plant. Support from the SCF also considers how informal waste pickers and recyclers can be integrated into the project to ensure community buy-in, assesses the potential of using renewable energy sources to power the plant, and evaluates the project’s feasibility of meeting regulatory requirements for emissions from waste combustion. The planned waste management sorting plant should be able to treat 150,000 tons of waste per year, reducing emissions, increasing recycling rates, and creating local jobs.

2. Transformative Actions Program

The Transformative Actions Program (TAP), led by ICLEI – Local Governments for Sustainability and supported by specialized partners, is a global initiative that helps subnational governments transform their sustainable infrastructure ideas into robust, bankable projects. Projects are mobilized through annual calls for applications and screened by sustainable finance experts. Projects with potential for impact receive personalized feedback and are connected to other PPFs that may provide further technical assistance, and to financial partners that could support their implementation. TAP supports projects at all stages of the project development cycle, in all sectors and geographical regions.

The project “Access to Sustainable Public Services" in Doumé (Cameroon) aims to establish a solar-powered potable water supply scheme and public lighting installation, to increase sustainable and equitable access to electricity and water for its more than 10,000 residents. At first, the project lacked the resources and capacity needed to demonstrate its feasibility and attract the estimated €2.4-3.8 million investment needed. By applying to TAP the project received technical assistance for a pre-feasibility study from ICLEI, who then facilitated the transfer of the project to Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ), which commissioned two additional pre-feasibility studies to assess several different technical and financial options for the water supply scheme and the improvement of public lighting. With these studies complete and now under review, the project in Doumé has made significant strides towards being investment-ready and able to attract finance for implementation.

3. City Climate Finance Gap Fund

Managed by the World Bank and European Investment Bank, the City Climate Finance Gap Fund, often simply called the Gap Fund, helps cities access critical financing to accelerate their low-carbon and climate resilient urbanization ambitions. With a focus on Latin America, Asia, Africa, and Eastern Europe, the Gap Fund offers cities a range of technical assistance and capacity building to support climate-smart planning. While the Gap Fund does not directly finance investments, it does offer project development guidance and assists in matching cities with potential funding sources as projects are developed.

In Indonesia, for example, the Gap Fund has provided technical support to six cities— Balikpapan, Banjarmasin, Cirebon, Malang, and Palembang—to develop low-carbon solid waste management (SWM) master plans. For each city, the GAP Fund is offering guidance around assessing existing SWM infrastructure, identifying areas for improvement, costing out financing for specific project elements, and developing metrics to track progress against the master plans. Alongside the technical support, the GAP Fund also offers government officials access to capacity-building opportunities on developing climate-smart waste solutions.

4. C40 Cities Finance Facility

The C40 Cities Finance Facility (CFF) supports cities in developing and emerging economies to create finance-ready projects that address the climate crisis while also tackling the broader socio-economic challenges faced by urban areas today. By collaborating closely with cities, the CFF helps transform sustainability priorities into bankable investment proposals. By 2025, the CFF is expected to reduce over 2.5 million tons of greenhouse gas emissions across 30 cities worldwide, increase the climate resilience of 2 million people, and mobilize USD 1 billion in climate finance investments.

In Dakar, Senegal, the Grand Yoff District often suffers from flooding caused by bursts of heavy rainfall, predicated to get worse under climate change. Illegal household and wastewater dumping in the existing stormwater retention basin exacerbates the flooding risks. Through the CFF’s support spanning from capacity development, facilitating multilevel and cross-departmental collaboration, technical hydrological studies and project structuring, the project has secured $11 million of funding for the redevelopment of the stormwater retention basin to reduce flood risks for 10,000 residents of the Grand Yoff district by creating higher-capacity and more effective stormwater retention infrastructure that also doubles up as a recreational area during the dry season.

5. Nature-based Solutions Accelerator for Brazilian Cities

Led by WRI Brasil, the Nature-based Solutions Accelerator for Brazilian Cities was designed to specifically address the lack of well-structured and financially feasible nature-based solutions projects in urban areas, by supporting early-stage city-led projects with design, scoping and project development support, mentoring, and the opportunity to pitch project ideas to funders. During its first cycle, the Accelerator supported the development of ten projects from cities in four regions in Brazil, and facilitated the exchange of knowledge and best practices between the cities, and with specialized proponents, experts and financiers of nature-based projects in Brazil.

Two projects – from the cities of Campo Grande and Maranguape – were selected based on their maturity and scalability potential to receive additional project preparation support to become investment-ready and access facilitated discussions with potential financiers and investors. In Maranguape, the Pirapora Park project aims to construct a multifunctional area along the Pirapora River, which runs through the city, in an area plagued by flooding due to unregulated urbanization. The park will include different nature-based solutions interventions such as naturalized detention basins, rain gardens, bioswales, and infiltration trenches which will slow and retain excess rainwater during floods, rehabilitate the river and improve the quality of the adjacent urban space, benefiting more than 11,000 people, of which more than 4,000 live in poverty. With technical support from the Accelerator, Maranguape conducted feasibility studies and developed a communications plan to engage stakeholders and the local community. This support strengthened the project, enabling the city to advance negotiations with the Brazilian National Development Bank for financing. A recent report published by WRI Brasil highlights the lessons learned from structuring early-stage nature-based solutions projects in Brazilian cities.

Conclusion

PPFs have a pivotal role to play in scaling up access to finance for urban transformation to build the cities of the future that we need – ones that are resilient to the risks that climate change poses, that are fair and equitable, that can adequately house future urban populations and meet their infrastructure needs, and that conserve and restore nature and biodiversity. By addressing the challenges of project development, PPFs can unlock investment opportunities, promote sustainability, and drive inclusive growth in cities worldwide.

Many cities, recognizing the connection between their urban development objectives and global climate and nature goals, are acting to promote integrated urban development solutions. 90 cities that are part of UrbanShift and the Global Environment Facility’s Sustainable Cities Impact Program are working to implement various innovative solutions, including low-emission green corridors in Buenos Aires, decarbonizing San Jose through fiscal and policy reform that supports integrated urban planning, and the restoration of Kadapakkam Lake and other waterbodies in Chennai to mitigate urban flooding, increase resilience to climate change, and support biodiversity.

UrbanShift supports these efforts by building capacity at our City Academy trainings and Geospatial Labs workshops, bringing cities together with financiers at Finance Academies and Investor Roundtables, and providing opportunities for knowledge exchange and information sharing between cities and stakeholders at Peer Exchanges and global advocacy events. Visit UrbanShift to learn more and discover how you can get involved.

UNEA-7 Cities and Regions Summit

Hosted in the lead-up to UNEA-7, this Summit will unite subnational leaders to strengthen collaboration and amplify the importance of cities.

Sustainable Finance Action and Advocacy: A Roadmap for Global South Cities

This C40-led webinar, held alongside 4th International Conference on Financing for Development (FfD4), aimed to equip mayors with the tools they need to advocate for expanded and accelerated access to urban climate finance.

UrbanShift Looks Back: On the Value of Expanding Access to Urban Climate Finance

C40's Jessy Appavoo, ICLEI's André Almeida da Vila, and UNEP's Sharon Gil share why and how UrbanShift has prioritized support for cities to access climate finance.

Unlocking Subnational Finance for Green Sectorial Transformation: A Focus on Buildings & Cooling

Hosted during COP30 in Belém, Brazil, these dynamic panel discussions will explore strategies for enhancing access to transformative finance, and how these resources can support local climate transitions.