Recap

Can you build an investment-ready climate project?

How the City Academy on Accessing Urban Climate Finance offers participants insights into funding sustainability projects, from financing sources to innovative instruments.

Written by Barbara Riedemann

Despite covering less than 2% of the earth’s surface, cities account for 78% of global energy use and 60% of total CO2 emissions. While cities have a huge potential to integrate sustainability into their development strategies, they face a significant funding gap, with only 1% of the required annual global climate finance reaching them. This is particularly pronounced in low- and middle-income countries due to low creditworthiness, limited fiscal decentralization, revenue uncertainty, and restricted access to capital markets.

These challenges were thoroughly explored during the UrbanShift Marrakech City Academy, where ICLEI led a three-day in-person training tailored to African local leaders and practitioners from Sierra Leone, Morocco, Rwanda, Senegal, Nigeria, Tanzania, and the Republic of Congo.

Cities’ representatives and UrbanShift partners convened to discuss funding sources and financing instruments for climate action projects, covering the entire spectrum from conception to implementation.

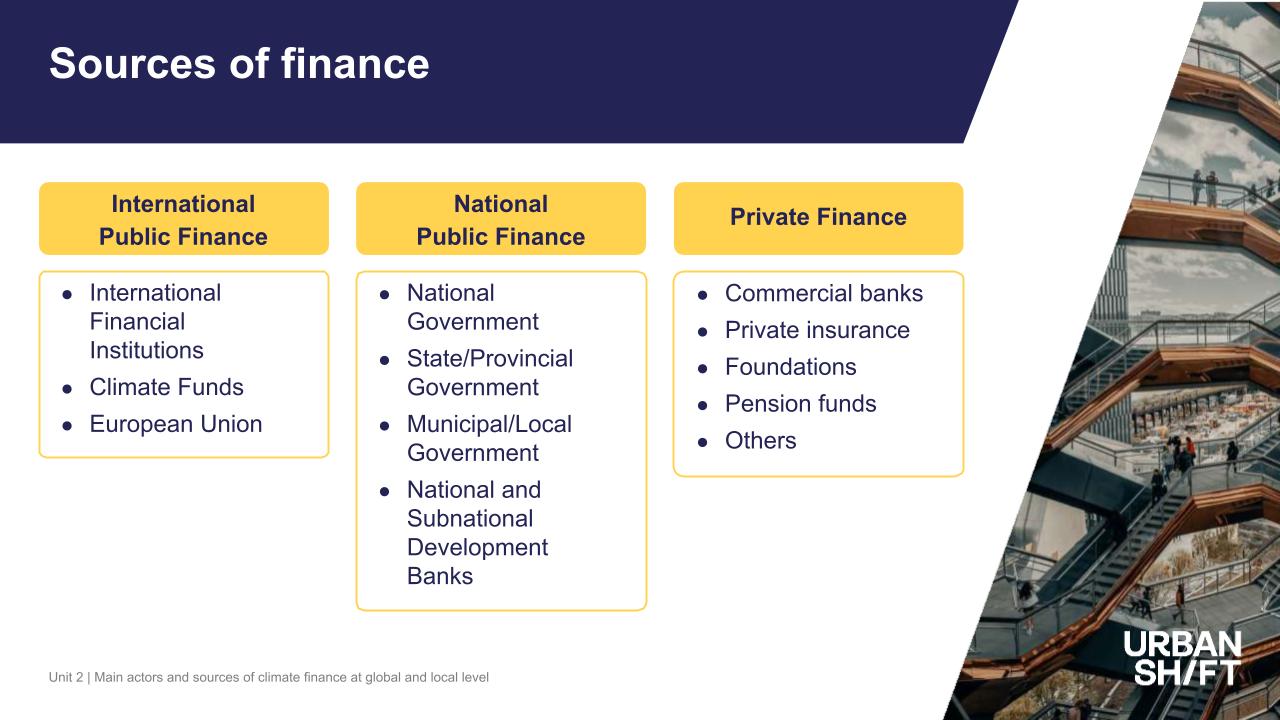

Funding sources

In the urban climate finance landscape, funding sources come from both public and private sectors. Public finance sources may stem internationally from entities such as financial institutions, climate funds, or supranational unions like the European Union, as well as domestically from governments and municipalities at the national and sub-national levels. Conversely, private finance sources encompass institutional investors, commercial banks, and philanthropic foundations, among others. According to Francisco Macedo, Senior Program Associate at CCFLA, private investment is currently the primary driver of urban climate finance.

Traditional finance instruments

The funding available to local governments greatly influences the services they can provide. When locally generated revenues are limited, cities’ expenditures suffer. Traditional finance instruments include own-source revenues (such as local taxes and tourist user fees), biodiversity-relevant subsidies, and intergovernmental transfers.

Own-source revenues (OSR) are the primary investment means for local governments, especially in developing countries. While Lennart Fleck, Programme Manager, Public Finance and Economic Development of UN-Habitat, highlighted them as crucial for attracting private investors and enhancing creditworthiness, many local governments in low-income countries only leverage around 20% of OSR.

So, how do we leverage OSR? According to Fleck, by using potential revenues of a project as a benchmark to identify real gaps, as well as conducting profitability analyses per revenue source. To this end, UN-Habitat created a tool (ROSRA) that assesses revenue leakages and breaks down existing bottlenecks to pinpoint underlying causes and opportunities for reform.

Other tools, like the United Nations Capital Development Fund’s (UNCDF) Local Climate Adaptive Living (LoCAL) Facility, support local governments in accessing climate finance for response and adaptation. LoCAL offers performance-based climate resilience grants alongside technical and capacity-building support. It strengthens national and sub-national financial systems, stimulating further funding for local adaptation through national fiscal transfers and global climate finance.

In addition, UNCDF’s Rebuilding Local Fiscal Space initiative offers tools to subnational governments to enhance their local fiscal capacity, focusing on four key factors identified post-COVID-19: loss of own-source revenues, challenges in intergovernmental fiscal transfers, decline in local economic development, and shifts in subnational government expenditures.

Innovative financing instruments

Governmental and own resources are often not enough to address the urban climate financing needs. That’s where innovative financing instruments come in.

While not necessarily new, these instruments are called “innovative” because they look at previously untapped solutions, often requiring collaboration between the public and private sectors.

One example includes the Green Sustainable Social bonds (GSS+), which combine climate, social, and sustainability elements. These bonds offer regulatory compliance, investment allure, and portfolio diversification benefits. According to Mike Brown, Senior Advisor of the Climate Bonds Initiative (CBI), GSS+ bonds encourage sustainable innovation and support climate-aligned capital planning, highlighting their importance in facilitating green investments and integrating sustainability into local government strategies.

Another example points to funding from UN agencies. One city that has successfully tapped into these external funding sources is Chefchaouen, Morocco. Chefchaouen realized it could save up to 50% of its energy by renovating its electrical system. After conducting a technical study, they applied for subsidies from the International Municipal Investment Fund (IMIF), granted by UNCDF. The city secured subsidies totaling USD 200,000 from the IMIF and an additional USD 375,000 from the Morocco Ministry of Interior. This was the first time that the national government of Morocco allowed a city to borrow from the UN system, marking a significant milestone.

Building investment-ready climate projects

Crafting a project entails a time-consuming and multi-stage process that includes project identification, stakeholder and expert engagement, accessing finance and technical options, demonstrating feasibility, securing finance, and implementation and monitoring. Although the details may differ based on local context, stakeholders, and the jurisdiction of the local government, these steps remain consistent.

Building political will is crucial for translating project ideas into tangible actions, as it fosters commitment and support from decision-makers. Here, the importance of analyzing project’s potential funders is crucial. Quentin Roquigny, Investment Officer at UNCDF revealed that public funders are risk-averse with complex transaction management, while private funders are more flexible and experienced.

The experts agree that accessing reliable data poses a significant challenge for local governments in making a project investment-ready.

Various institutions have established Project Preparation Facilities (PPFs) to address these challenges, offering support services throughout the project life cycle. However, Project Preparation Facilities often tend to favor projects that match their portfolio and capabilities rather than focus on the projects’ potential impacts. The Transformative Actions Program (TAP) addresses this providing a one-stop interface for subnational governments and local businesses to submit their sustainable infrastructure projects, which are then supported by the various Project Preparation Facilities backing TAP. TAP facilitates the creation of solid, investment-ready projects through capacity-building, knowledge sharing, and access to financing. It ensures projects of all sizes and stages can receive guidance and explores funding options tailored to their needs and circumstances. Projects are submitted annually and reviewed by financial and technical experts at ICLEI. The 2024 TAP call opens on 1 March.

With the UrbanShift Marrakech City Academy, ICLEI is once again spearheading finance training sessions, bridging cities with global expertise and cutting-edge research in accessing urban climate finance. Following its successful debut at the 2023 UrbanShift Asia Forum, ICLEI is set to repeat this training at the UrbanShift Latin America Forum in Belém, Brazil, from 16 to 19 April. These cross-regional finance trainings provide insights into the diverse needs of local governments and help connect cities with finance experts, advancing the much-needed urban climate finance initiatives worldwide.

UrbanShift Annual Report 2023-2024

With a focus on accelerating urban climate finance and multi-level government, UrbanShift's third annual report dives into stories of progress and innovative ideas from across our network.

How National Governments Can Increase Finance for Subnational Climate Action

This report is aimed at defining implementation options for national governments to significantly scale up finance for subnational climate action in close partnership with subnational governments, development partners, and the private sector.

Business Models for Financing Nature-Based Solutions in Urban Climate Action

This publication serves as a comprehensive guide to financing and developing business models for Nature-based Solutions (NbS) addressing climate challenges in urban areas.

National Climate Finance Vehicles: Best Practice Insights from International Case Studies

The report presents a model design framework and readiness criteria for clarifying the key factors supporting effective operation and achieving prioritized climate outcomes and sustainable development.